A Tale of Two Healthcare Systems: India's Public vs. Private

Can India's Public Hospitals Compete with Private Giants?

India presents a special difficulty in blending public and private healthcare systems because of its large population and varied healthcare requirements. Millions of people receive affordable healthcare from the public sector, yet the private sector frequently provides cutting-edge facilities and specialized treatments.

The Public Healthcare Landscape

India is home to an extensive network of public hospitals, including approximately 23,600 facilities and 710,460 beds. Nevertheless, there is a severe imbalance in the distribution of these resources, with only 15 states and union territories home to 84% of hospital beds. 33% of all hospital beds in the nation are located in the top three states, West Bengal, Tamil Nadu, and Uttar Pradesh.

The government has allocated large sums of money to organizations like AIIMS, PGIMER, and JIPMER in order to improve public healthcare. A budget of ₹4,523 crores, or an average of ₹1.42 crores per bed, has been assigned to AIIMS New Delhi for the fiscal year 2024–25.

A Comparative Analysis

When we compare the budgetary allocations for public hospitals with those of private healthcare providers, a striking disparity emerges. Max Healthcare, a leading private hospital chain in India, spent ₹4,157 crores on 4,299 beds, resulting in an average expenditure of ₹0.96 crores per bed.

This analysis raises several questions:

Are public hospitals being allocated sufficient funds to provide quality healthcare?

Can public hospitals compete with private institutions in terms of infrastructure, equipment, and patient care?

How can India ensure equitable access to healthcare for all its citizens?

The Road Ahead

To address these challenges, India needs to adopt a multifaceted approach that includes:

Greater funding: To guarantee that hospitals have the means to deliver high-quality care, the government should devote a larger portion of its budget to public healthcare.

Modern infrastructure, including state-of-the-art facilities and equipment, should be included in public hospitals.

Enhanced human resources: To provide high-quality healthcare, there must be a sufficient number of qualified physicians, nurses, and other healthcare professionals on staff.

Public-private partnerships: By combining the resources of both public and private healthcare systems, partnerships can increase accessibility and affordability.

Digital health and telemedicine: Making use of technology can help increase access to healthcare, particularly in rural regions.

The State of Hospital Infrastructure in India: A Deep Dive into Bed Allocation and Budgeting

India's healthcare landscape is vast, with over 710,000 hospital beds across 23,600 public hospitals. However, a staggering 84% of these beds are concentrated in just 15 states and UTs, with a significant 33% in the top three states alone. Let’s unravel the numbers and implications of this distribution, exploring budget allocations and comparing public and private spending on hospital infrastructure.

The statistics around India's hospital bed distribution both fascinating and alarming. With over 710,000 beds spread across 23,600 public hospitals, you'd expect a more even distribution, but that's not the case. A staggering 84% of these beds are concentrated in just 15 states and Union Territories (UTs), with the top three states—West Bengal, Tamil Nadu, and Uttar Pradesh—housing a whopping 33% of the total beds. This raises several questions about equity, resource allocation, and the future of healthcare in India.

1. The Allocation Conundrum: A State-Wise Breakdown

Let’s start by visualizing the numbers:

West Bengal: As one of the top three states, West Bengal holds a significant share of hospital beds, reflecting its dense population and healthcare needs.

Tamil Nadu: Known for its extensive healthcare infrastructure, Tamil Nadu's bed count underscores its commitment to healthcare services.

Uttar Pradesh: With its large population, Uttar Pradesh's bed allocation highlights the challenge of meeting healthcare needs in high-density areas.

2. Budget Insights: Public vs. Private Spending

To understand the financial implications, let’s delve into the budget allocations for some premier institutions:

AIIMS, New Delhi: Allocated ₹4,523 Crore, translating to ₹1.42 Crore per bed.

PGIMER, Chandigarh: Receives ₹2,200 Crore, or ₹1.12 Crore per bed.

JIPMER: With ₹1,440 Crore allocated, this comes to ₹0.65 Crore per bed.

The average budget across these institutions is ₹1 Crore per bed, but let’s consider a more conservative estimate of ₹0.6 Crore per bed. This provides a more realistic picture of budgetary allocations across various states and UTs.

3. The Financial Footprint: Government vs. Private Sector

When we project this conservative budget across the top 15 states:

Total Spending: ₹394,383 Crore annually, which translates to around $47 Billion.

In contrast, let’s examine the private sector's expenditure:

Max Healthcare: Spent ₹4,157 Crore on 4,299 beds, equating to ₹0.96 Crore per bed.

This comparison highlights a few critical insights:

Public Sector Spending: Government hospitals are investing significantly in infrastructure, but the disparity in bed distribution suggests a need for more equitable resource allocation.

Private Sector Efficiency: Max Healthcare’s spending, though lower per bed, reflects a different approach to healthcare investments, possibly indicating a more efficient use of resources.

4. Implications and Reflections

What does this data tell us about India's healthcare system? Here are a few takeaways:

Equity in Healthcare

The concentration of beds in just a few states raises questions about equity. States with fewer beds may struggle to provide adequate healthcare services, highlighting a disparity that needs addressing.

Budget Efficiency

The variation in per-bed costs between public and private sectors suggests different approaches to healthcare investment. While public hospitals might have higher per-bed costs, they also serve a larger population and often provide more comprehensive services.

Future Considerations

The data underscores the need for a balanced approach to healthcare infrastructure. Investing in underserved regions and optimizing resource use in high-density areas could lead to a more equitable healthcare system.

5. Moving Forward: Recommendations

To address these issues, several steps could be taken:

Increase Investment in Underserved Areas: Ensuring that regions with fewer beds receive adequate funding to improve their healthcare infrastructure.

Optimize Resource Allocation: Leveraging technology and management strategies to enhance efficiency and reduce per-bed costs.

Encourage Public-Private Partnerships: Collaborations between public and private sectors could lead to more innovative solutions and better resource utilization.

India’s healthcare infrastructure is grappling with several significant challenges, including a critical shortage of hospital beds, inadequate basic equipment, and an uneven distribution of facilities, particularly in rural areas:

Challenges in India's Healthcare System

Bed Shortage:

India has fewer than 1.4 hospital beds per 1,000 people, starkly below the World Health Organization’s recommended benchmark of 3.5 beds per 1,000 people.

Rural Hospital Shortage:

There is a notable deficit of hospitals in rural areas, with only 30% of the country’s total beds located in these regions. This discrepancy underscores the urgent need to enhance healthcare access in underserved areas.

Equipment Shortage:

Many healthcare facilities are under-equipped, lacking essential medical tools and resources that are vital for effective patient care.

Population Pressure:

The immense and growing population puts additional strain on the healthcare infrastructure. On average, each government hospital serves approximately 90,972 people, and every government hospital bed caters to around 2,012 individuals.

Progress and Developments

Despite these challenges, there have been notable advancements in India's healthcare infrastructure:

Increase in Facilities:

The number of government hospitals and dispensaries has surged from 9,300 in 1951 to 53,800 in 2018.

Growth in Medical Personnel:

The number of nursing personnel has reached 3 million, and allopathic doctors have increased to 1.15 million since 1951.

Expansion of Primary Health Centers (PHCs):

The establishment of PHCs in villages has been a significant step towards improving healthcare access in remote areas.

International Collaboration:

India has secured loans from the Asian Development Bank (ADB) and the Japan International Cooperation Agency (JICA) to bolster healthcare infrastructure. Additionally, the World Bank has approved $1 billion for the Pradhan Mantri Ayushman Bharat Health Infrastructure Mission (PM-ABHIM).

Current Infrastructure:

There are 11,613 hospitals in India with a total of 540,328 beds. Of these, 6,281 hospitals are located in rural areas, providing 143,069 beds, while 3,115 hospitals in urban areas offer 369,351 beds. Note that detailed rural and urban bed distribution data is not available for the states of Bihar and Jharkhand.

These developments highlight ongoing efforts to address healthcare challenges, though significant improvements are still needed to ensure equitable access and better-quality care across the country.

Understanding ARPOB in the Hospital Industry

ARPOB stands for Average Revenue Per Occupied Bed. It’s a measure used in the hospital industry to see how much money a hospital makes on average for each bed that is occupied.

Key Points:

ARPOB Range: The ARPOB for selected hospitals is between Rs. 29,500 and Rs. 79,000. This means some hospitals earn a lot more for each occupied bed than others.

Higher ARPOB ≠ Higher Profit: Just because a hospital has a high ARPOB doesn’t mean it makes more profit. Profitability depends on other factors too.

Factors Influencing ARPOB: Several things can affect ARPOB:

Location: Hospitals in busy or affluent areas may charge more.

Product Mix: The types of services offered (like surgeries vs. general care) can change revenue.

Business Mix: Different types of patient contracts (like insurance vs. out-of-pocket).

Payor Mix: The mix of patients with different payment sources (insurance types) affects income.

Profitability Factors: Profitability is influenced by:

Direct Expenses: The costs directly associated with providing services (like salaries of doctors).

Overheads: General costs of running the hospital (like utilities and administrative expenses).

Examples:

A hospital with high international business might have a higher ARPOB but may spend a lot on marketing and sales.

A hospital focusing on high-end procedures might also have a high ARPOB but pays more for skilled doctors and advanced equipment.

Conversely, a hospital operating with lower costs and simpler infrastructure may show better profit margins despite a lower ARPOB.

ARPOB is an important metric but doesn’t tell the whole story. To get a clearer picture of a hospital’s financial health, it’s better to look at ACPOB (Average Contribution per Occupied Bed), which considers the actual contribution to profit after costs. Many clients are now focusing on this metric for better financial analysis and planning.

In summary, while ARPOB is useful, it should be looked at alongside other factors to understand a hospital's true profitability.

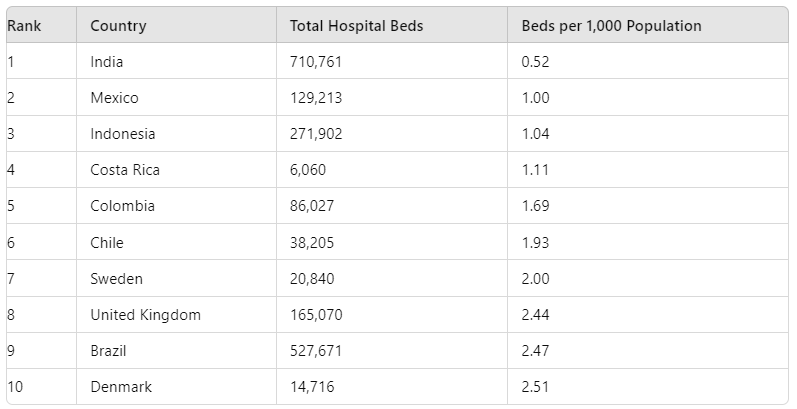

Which Country Has the Fewest Hospital Beds Per Person?

When evaluating a country's healthcare system, one crucial metric to consider is the number of hospital beds available per 1,000 people. This figure helps gauge the capacity of a healthcare system to accommodate patients and manage medical needs efficiently. Essentially, more hospital beds mean better access to treatment and shorter waiting times for patients.

India currently holds the unfortunate position of having the fewest hospital beds per person in the world. With only 0.52 beds per 1,000 people, India's healthcare infrastructure is severely strained. This low number of beds highlights the challenges faced by the country's healthcare system, making it crucial for expats and digital nomads in India to have comprehensive health insurance that covers private medical care.

It’s important to note that the latest data available from India is from 2017, as the country ceased providing updates to the OECD after that year. Therefore, these statistics may have changed by 2024. However, the stark contrast remains significant, with India lagging behind countries like Mexico, which offers nearly twice as many beds per 1,000 people.

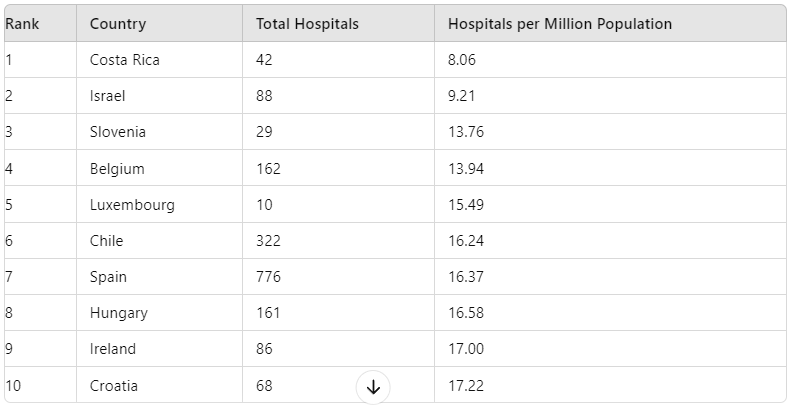

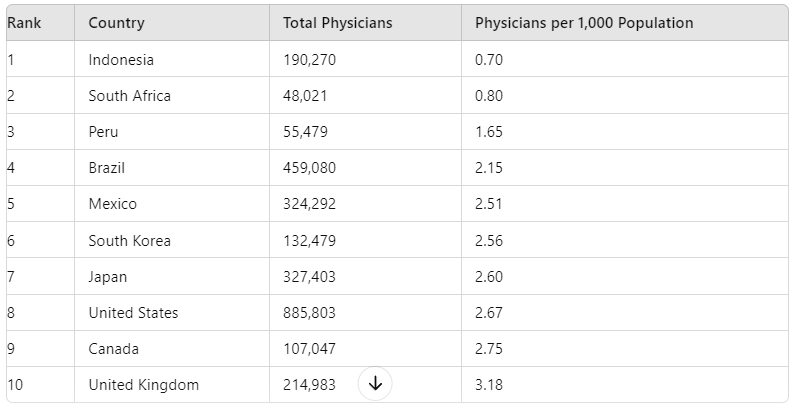

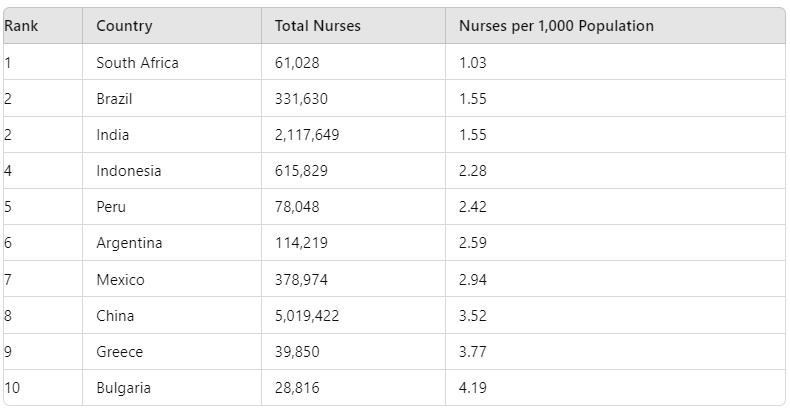

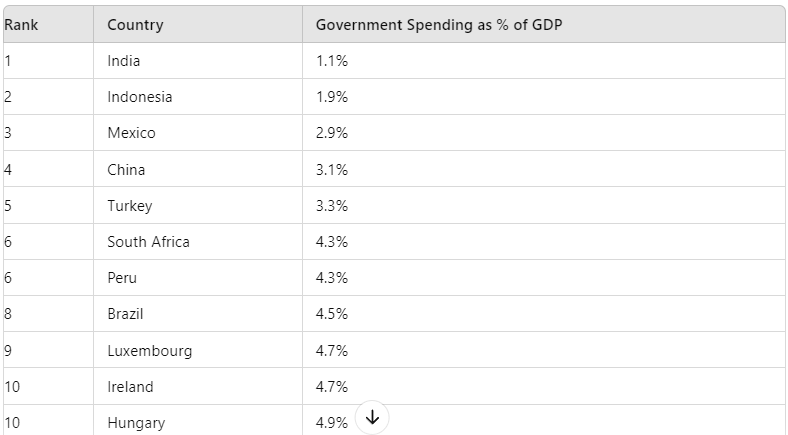

Top 10 Worst Countries for Healthcare Metrics (2024)

Here’s a snapshot of hospital bed availability across various countries:

Number of Hospital per million population

Number of Physicians per 1000 population:

Number of Nurses per 1000 population

Government Spending:

Source: william-russell

The Healthcare Crisis: A Global Snapshot

Healthcare, once a luxury, is now a necessity. But not everyone has equal access.

In 2024, the world is witnessing a rapid evolution in healthcare. From AI-powered diagnostics to personalized medicine, the future of healthcare seems brighter than ever. However, beneath this shiny veneer, a stark reality persists: healthcare inequality.

While some countries boast world-class facilities and highly skilled professionals, others struggle with a shortage of basic medical resources. This disparity is not just a moral issue; it's a global health crisis.

But why is this happening?

Several factors contribute to this uneven distribution of healthcare.

Government spending, infrastructure, and the availability of medical professionals are just a few. Let's dive deeper into these factors and explore some countries that are grappling with healthcare challenges.

A Hospital Bed for Every Patient? Not So Fast.

One of the most fundamental indicators of healthcare quality is the availability of hospital beds. Unfortunately, many countries, particularly those with burgeoning populations, are struggling to keep up with the demand.

India, for instance, despite being a global economic powerhouse, faces a severe shortage of hospital beds. This, coupled with a large population, means that many patients have to wait for extended periods for essential medical care.

On the other hand, countries like Switzerland and Norway have a surplus of hospital beds, ensuring that their citizens have timely access to medical treatment.

The Doctor Shortage

Another critical factor is the availability of medical professionals. A shortage of doctors, nurses, and other healthcare workers can lead to longer waiting times, overburdened staff, and compromised patient care.

Indonesia and South Africa are among the countries grappling with a significant doctor shortage. This has severe implications for public health, as many people are unable to access necessary medical services.

In contrast, countries like Austria and Norway have a relatively high ratio of medical professionals to population, ensuring that their citizens receive adequate healthcare.

Government Spending

Government spending on healthcare is a crucial determinant of its quality and accessibility. Countries that allocate a larger portion of their GDP to healthcare typically have better health outcomes.

The United States, despite being one of the wealthiest nations in the world, spends a significantly higher percentage of its GDP on healthcare compared to many other developed countries. However, this spending does not always translate into better health outcomes for all citizens.

On the other hand, countries like India and Indonesia struggle with low healthcare spending, which limits their ability to provide quality care to their populations.

The healthcare landscape is complex and multifaceted. While some countries have made significant strides in improving access to healthcare, others continue to face significant challenges.

Costa Rica: A Surprising Shortfall in Hospitals

When we think of Costa Rica, we often imagine lush landscapes and a haven for expats. Yet, the country is facing a glaring healthcare challenge: the fewest hospitals per capita. With only 8.06 hospitals per million people, Costa Rica has seen a decline in hospital availability over the past decade. Despite its affordable living and growing popularity among digital nomads, the lack of hospital infrastructure remains a significant concern.

India: Scarcity of Hospital Beds and Medical Professionals

India, a country known for its rapid economic growth and technological strides, faces a stark contrast in healthcare. With just 0.52 hospital beds per 1,000 people, the pressure on the existing healthcare system is immense. This shortage is compounded by a low number of physicians and nurses, with only 0.7 doctors per 1,000 people. The system is stretched thin, making it crucial for expats to secure comprehensive health insurance.

The Struggle for Medical Staff

Globally, the availability of medical professionals varies significantly. Countries like Indonesia and South Africa are struggling with the fewest physicians and nurses per capita. Indonesia, with just 0.7 physicians per 1,000 people, and South Africa, with a mere 1.03 nurses per 1,000 people, highlight severe shortages that impact the quality of care. These countries need urgent reforms to bolster their healthcare workforce.

The Issue of Spending: Why Some Nations Lag Behind

The amount of money the government spends on healthcare has a big impact on the standard of care. India spends an embarrassingly little 1.1% of GDP, which is shockingly low for a nation with its needs and population. On the other hand, with 14.1% of its GDP going into healthcare, the United States spends more than any other country. The variations in healthcare accessibility and quality observed globally are mostly attributable to this financing gap.

The Diagnostic Equipment Divide

When it comes to diagnostic tools like MRI scanners, there’s a vast divide between nations. Japan tops the list with 57.39 MRI scanners per million people, while Colombia languishes at the bottom with just 0.24 per million. This discrepancy underscores the broader issue of technological access in healthcare, impacting early diagnosis and treatment outcomes.

What Can Be Done?

Recognizing these differences is the first step in resolving them. It's crucial for everyone thinking about moving or traveling to investigate healthcare facilities and make sure they have enough insurance. There is an urgent need for legislators and global health organizations to prioritize raising healthcare spending, enhancing the availability of medical personnel, and growing diagnostic capacity.

A multimodal strategy is needed to address healthcare disparity, including greater government funding, better infrastructure, and more healthcare professional training. Together, we can make sure that everyone has access to the healthcare they need, irrespective of where they live or their financial situation.

India’s Healthcare Revolution: What to Expect in 2024

As we step into fiscal year 2023-24, India’s healthcare sector is gearing up for a significant transformation. With total health expenditure projected to reach a staggering Rs 79,220 crore, a substantial increase from the previous year’s Rs 72,268 crore, the landscape of Indian healthcare is evolving rapidly.

Currently, nearly half (49.8%) of India’s healthcare expenses are paid out of pocket by individuals. This financial burden is coupled with an expanding insurance market, which creates a wealth of opportunities for innovation and improvement in patient care. We are enthusiastic about the transformative potential of businesses pioneering in the healthcare sector to enhance patient outcomes across the country.

The Dawn of Health OS: Breaking Down Silos

Historically, healthcare data in India has been fragmented, leading to disjointed patient care and inefficient interactions among healthcare providers. However, the advent of the Ayushman Bharat PM-JAY scheme is set to revolutionize this scenario. The scheme’s focus on the United Health Interface (UHI), digital registries, and electronic health records (EHR) is poised to address these issues head-on.

The Ayushman Bharat Digital Mission (ABDM) is at the forefront of this transformation, aiming to unify healthcare data and improve patient engagement. EkaCare, one of our portfolio companies, exemplifies this shift with over 11 million downloads, 1 million monthly active users, and more than 85 million health records managed on its platform. EkaCare is redefining how individuals interact with healthcare services, emphasizing a family-first approach to managing health records.

India’s Emerging Role in Global Healthcare Innovation

According to a recent Bain report, India’s healthcare innovation sector represents a $30 billion opportunity, primarily driven by pharma services and health tech. While biotech and medtech are still developing, they are showing promising early signs. India’s growing talent pool and cost advantages position the country as a future hub for pharmaceutical and biotechnological advancements.

Key areas of potential include:

Sustainable and Global Supply Chains: India is well-positioned to develop efficient global networks for alternative ingredients and end-products, contributing to a more sustainable healthcare supply chain.

Cost-Efficient Intellectual Property (IP): Over the next decade, India is expected to become a center for innovative IP in pharmaceuticals, medical devices, and synthetic biology. The ability to leverage cost advantages while creating globally viable products is crucial for success.

Enhancing Provider Productivity

With over 13 lakh allopathic doctors and 36 lakh nursing personnel registered in India, the current doctor-population ratio stands at 1:833, and the nurse-population ratio is 1:475. As the population grows, the healthcare system needs a major overhaul to improve efficiency and patient care.

Key opportunities for innovation include:

Patient Experience Management: Solutions that enhance the management of patient experiences in hospitals and clinics are essential for improving overall care.

Remote Patient Monitoring: Technologies that allow for remote monitoring of patients can increase accessibility and efficiency in healthcare delivery.

Integrated Payer Experience: Streamlining the payer experience with integrated solutions can simplify processes and reduce costs.

Data Interoperability and Analytics: Advanced analytics and improved data sharing between providers can lead to better patient outcomes and more informed decision-making.

Provider Enablement: Empowering healthcare providers with the right tools and technologies can significantly boost productivity and care quality.

The Future is Bright

India’s healthcare sector is on the cusp of a major transformation, driven by technological advancements and a growing emphasis on integrated patient care. By addressing existing challenges and embracing innovation, the sector has the potential to unlock new revenue streams and significantly enhance patient outcomes.

We believe that the intersection of technology and healthcare will continue to offer immense opportunities. As we advance into 2024, we are excited about the potential for groundbreaking solutions that will redefine patient care and drive substantial improvements across the healthcare ecosystem.

Data Sources and Recent Updates on India's Healthcare Infrastructure

Government Reports and Publications:

National Health Profile (NHP): The Ministry of Health and Family Welfare publishes the NHP annually, providing comprehensive data on India's healthcare system, including hospital beds, medical personnel, and health facilities. https://mohfw.gov.in/

Census of India: The Office of the Registrar General and Census Commissioner of India conducts the Census, which includes data on healthcare facilities and their distribution.

http://www.censusindia.gov.in/

State Health Surveys: Many states in India conduct their own health surveys, providing detailed information on healthcare infrastructure and access at the state level.

Research Institutions and Think Tanks:

Indian Council of Medical Research (ICMR): The ICMR conducts research and provides data on various health issues, including healthcare infrastructure. https://www.icmr.gov.in/

National Institute for Research in Reproductive Health (NIRRH): NIRRH focuses on reproductive health and family planning, and its research often includes data on healthcare infrastructure. https://nirrch.res.in/

NITI Aayog: The NITI Aayog, India's premier policy think tank, frequently publishes reports on various sectors, including healthcare, which may include data on infrastructure and access. https://www.niti.gov.in/

Recent Updates (as of September 2024):

Although NHP data for 2022 is the most current available, India's healthcare system has seen substantial changes since then. Among the noteworthy updates are:

PM-ABHIM: The nation's healthcare facilities are gradually being upgraded as part of the Pradhan Mantri Ayushman Bharat Health Infrastructure Mission.

State-Level Initiatives: A number of states have started their own healthcare projects, including expanding the number of healthcare workers, renovating old facilities, and constructing new hospitals.

COVID-19 Response: The epidemic has sped up the deployment of telemedicine and digital health technology, which may enhance rural residents' access to healthcare.

Conclusion

India's public healthcare system is a vital component of the country's healthcare landscape.However, it is essential to address the issues and make improvements in order to fulfill the population's expanding needs. India can guarantee that its public hospitals are able to offer all of its residents high-quality, reasonably priced healthcare by taking a holistic strategy.

There are advantages and disadvantages to India's unequal distribution of hospital beds and funding. Stakeholders can work toward a more equal and effective healthcare system by comprehending these dynamics. For the purpose of enhancing healthcare results across the country, it is imperative that everyone involved—politicians, medical professionals, and concerned citizens—remain knowledgeable and support equitable resource distribution.

Feel free to share your thoughts or questions in the comments below. Let’s continue this important conversation and work towards a better future for India’s healthcare system.

What did you think of this article?

We value your feedback and would love to hear your thoughts on this article.

Write to: hello [at] watchdoq [dot] com with questions or comments.

Additional Resources