Health Insurance Claim Settlement Ratios: Which Company Stands Out?

Selecting the best health insurance plan can be difficult, particularly if you're surrounded by a sea of information. The claim settlement ratio (CSR) is one of the most significant measures that can assist you in making an informed decision. In short, it's a percentage that indicates the likelihood that an insurance provider will pay out on your claim when you most need it. Here, we examine the top insurance firms' claim settlement ratios in conjunction with their Incurred Claim Ratio (ICR), which is a crucial measure of an insurer's long-term viability and profitability.

Why Claim Settlement Ratio Matters

Assume you have been paying for years for health insurance. You file a claim when a medical emergency occurs one day. Right now, you'll want the insurance provider to promptly and completely resolve your claim. A high ratio of claims settled indicates that the business is trustworthy and pays out on a regular basis. Conversely, a low CSR can point to possible obstacles in the process of getting your money back.

HDFC Ergo: The Most Balanced Insurer

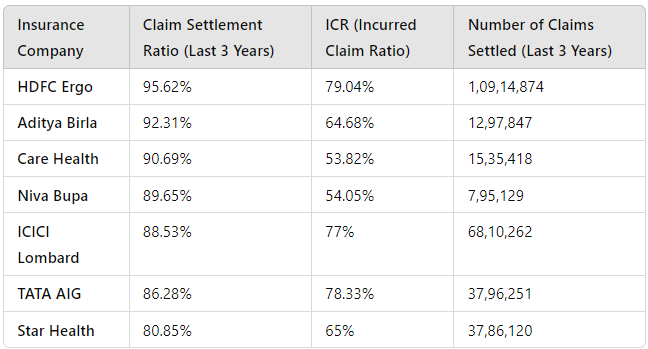

Among the top players, HDFC Ergo shines the brightest with a CSR of 95.62% and a solid Incurred Claim Ratio (ICR) of 79.04%. This combination makes HDFC Ergo a well-balanced insurer—efficient in settling claims and financially sound in managing its funds. With over 1.09 crore claims settled in the last three years, it’s a clear leader in both quantity and quality of service.

Why is this significant? When an insurer has both a high CSR and a decent ICR, it suggests that the company is not only prompt in settling claims but is also financially stable. This balance assures policyholders that the company will be around in the long run to fulfill future claims, a major plus when considering long-term health coverage.

Aditya Birla Health Insurance: High Claims, Low Profits?

Next on the list is Aditya Birla Health Insurance, boasting a CSR of 92.31%. While it may seem like a strong contender based on claim settlement, its ICR of 64.68% tells a different story. A lower ICR suggests that the company is paying out more in claims than it is collecting in premiums, which might impact its profitability and sustainability in the long term. With around 12.97 lakh claims settled, it’s a great option for those focused on claim settlement, but you might want to keep an eye on its financial health if you’re looking for coverage over many years.

Care Health Insurance: Strong on Settlements, Weaker on Financial Stability

Care Health Insurance offers a similar picture with a CSR of 90.69% but a lower ICR of 53.82%. While the company has settled over 15 lakh claims in the last three years, its financials raise some concerns. Like Aditya Birla, it’s paying out significantly more in claims than it collects from premiums, which could mean a weaker financial position in the future. It’s ideal for those who prioritize quick claim settlements, but sustainability might be a question.

Niva Bupa and Star Health: Reliable Yet Financially Strapped?

Niva Bupa and Star Health also showcase impressive claim settlement numbers, with CSRs of 89.65% and 80.85%, respectively. However, both have lower ICRs—54.05% for Niva Bupa and 65% for Star Health—indicating that while they are reliable in settling claims, their profitability could be better.

ICICI Lombard and TATA AIG: Solid Financial Backing

Two insurers that stand out in both claim settlement and financial health are ICICI Lombard and TATA AIG. With CSRs of 88.53% and 86.28% and high ICRs of 77% and 78.33%, respectively, these companies provide a solid combination of reliable claim settlement and financial stability. ICICI Lombard settled over 68 lakh claims, while TATA AIG handled around 37 lakh claims, making them both strong contenders for anyone seeking balanced insurance options.

What’s the Ideal Claim Settlement Ratio and ICR?

An ideal CSR lies between 94%-99%, while the recommended ICR range is 70%-90%. A high CSR ensures that your claims are likely to be honored, while a healthy ICR means the company is financially stable enough to sustain its operations and serve you in the long run.

Final Thoughts

Selecting a health insurance plan is not only about comparing costs. You want a provider who can cover you at a reasonable cost and honors claims at the most inconvenient times. In light of this, HDFC Ergo stands out as the best value alternative, while TATA AIG and ICICI Lombard provide reliable, steady solutions for individuals seeking both stability and financial strength.

Aditya Birla and Care Health Insurance are also great choices if you value strong claim settlement ratios more than the insurer's long-term financial stability. However, striking a balance between CSR and ICR is crucial for people searching for a long-term companion in their health journey.

Ultimately, the best health insurance is one that not only covers you when you need it but also has the financial backing to do so for years to come.

Claim Settlement Ratio (CSR):

A high CSR indicates that the insurance company is likely to settle claims promptly and efficiently.

However, a high CSR alone does not guarantee that claims will be settled without any issues. Other factors, such as the specific terms and conditions of the policy and the individual circumstances of the claim, can also influence the claim settlement process.

Incurred Claim Ratio (ICR):

A high ICR indicates that the insurance company is paying out more in claims than it is collecting in premiums. While this may seem like a negative, it can also be a sign that the company is fulfilling its obligations to policyholders.

A low ICR may suggest that the company is not paying out as much in claims as it should, which could be a concern for policyholders.

However, it is important to consider the overall financial health of the insurance company, as well as other factors such as the company's investment strategy and risk management practices.

Choosing the Right Health Insurance Plan:

When choosing a health insurance plan, it is important to consider not only the CSR and ICR, but also other factors such as the coverage offered, the premium amount, and the insurer's reputation.

It is also recommended to read the policy document carefully to understand the terms and conditions, including any exclusions or waiting periods.

Comparing quotes from multiple insurers can help you find the best plan for your needs and budget.

Factors Affecting Claim Settlement Ratios: Besides the ICR, other factors that can influence a company's CSR include:

Underwriting Practices: How strictly the company screens applicants for potential risks.

Fraud Detection: The effectiveness of the company's fraud detection systems.

Claim Processing Efficiency: The speed and accuracy of the claim settlement process.

Customer Service: The quality of customer service provided to policyholders during the claim process.

Industry Trends: Keep an eye on industry trends and developments that may affect claim settlement ratios.

For example, changes in healthcare costs, regulatory policies, or economic conditions can impact insurers' profitability and their ability to pay claims.

Policyholder Reviews: Read reviews and testimonials from other policyholders to get a sense of their experiences with different insurance companies.

Resources and Links

IRDAI (Insurance Regulatory and Development Authority of India): The official website of the IRDAI provides information on the insurance industry in India, including data on claim settlement ratios and other key metrics. https://irdai.gov.in/

Insurance Information Bureau (IIB): The IIB is an independent body that collects and analyzes data on the Indian insurance industry. They publish reports and statistics on claim settlement ratios and other relevant metrics. https://irdai.gov.in/iib1

Consumer Affairs Ministry: The Consumer Affairs Ministry provides information and assistance to consumers, including guidance on filing insurance claims and resolving disputes. https://consumeraffairs.nic.in/

Insurance Comparison Websites: Websites like PolicyBazaar, CompareRaja, and PolicyXpert allow you to compare health insurance plans from multiple insurers based on various factors, including claim settlement ratios and premiums.

Additional Tips for Research

Look for Recent Data: Ensure that the data you are using is up-to-date. Claim settlement ratios can fluctuate over time.

Consider Multiple Sources: Don't rely solely on one source of information. Compare data from different sources to get a more comprehensive picture.

Consult with an Insurance Advisor: If you are unsure about which health insurance plan to choose, consider consulting with an insurance advisor who can provide personalized guidance.

What did you think of this article?

We value your feedback and would love to hear your thoughts on this article.

Write to: hello [at] watchdoq [dot] com with questions or comments.

Additional Resources